Gross Profit & Gross Profit Margin

Important Factors For Your Business

Understanding these could make you much more money in your business

Before we get started let me just say there’s a lot of confusion on the terms Gross Profit, Gross Margin and Gross Profit Margin. In order to ensure that you at least have a good chance of following what I’m refering to in the following article, allowe me please to verify the following:

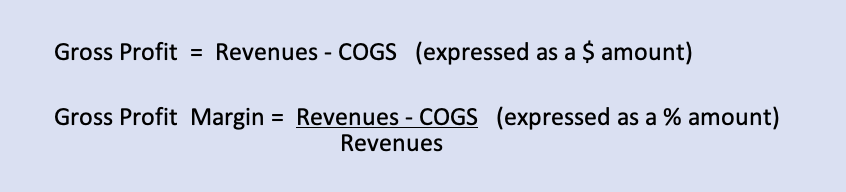

Gross Profit and Gross Margin are actually the same thing and is equal to Revenues (Sales) – Cost of Goods Sold (COGS). This amount is stated as a dollar amount.

Gross Profit Margin is in my use the Gross Profit divided Revenues, and is expressed in %. Even Wikipedia states last time I checked that sometimes it’s stated as dollar amount and sometimes as a percentage.

In my use the operative word to distiguish is margin. I will endeavor to add the % sign to limit any confusion

This article is intended to help you make a lot more money with your business. Bear with me as the article is long, but I believe you will gain renewed and deeper understanding as well as renewed motivation to make your business better so you can make more money.

Gross Profit is sometimes referred to as Sales Profit or even more often as Gross Income. Gross Profit is also often called Gross Margin, which should NOT be misunderstood for Gross Profit Margin.

A lot of people use incorrectly the Gross Margin and the Gross Profit Margin interchangeably. The former is expressed as a dollar value, and the latter is expressed as a percentage.

Both of these numbers are some of the most important of the business numbers to understand, to track and to improve upon whenever possible. Yet, many business owners are often too busy pursuing just more sales, or as it often is the case, putting out fires here and there or focusing on a myriad of other things.

I especially find the Gross Profit Margin (%) important to keep an eye on, because you can have your Gross Profit increase, while your Gross Profit Margin actually decrease.

In other words, the Gross Profit Margin is a better number to use to measure a company’s efficiency, especially when looking at evolution of the business over time

Gross Profits is a critical number for you to really have in mind when you create, grow, optimize and generally run your business. You may say the Gross Profits measure the value of your output activities. Your output being the real business activities you carry out which are directly associated with your sales.

Gross Profits measure the value of your output activities

Unfortunately, my experience having helped a lot of companies all over has clearly demonstrated to me that a lot of business owners are somewhat, if indeed not completely, oblivious and unaware of the importance of the Gross Profit number and it’s importance.

In fact, a lot of the books of many clients I have helped their Gross Profits according to their Profit and Loss Statements showed the same number as their Revenue (Sales), meaning that the Costs Of Good Sold was not identified and entered in the bookkeeping as Cost Of Goods Sold items.

A Little Housekeeping Is Needed

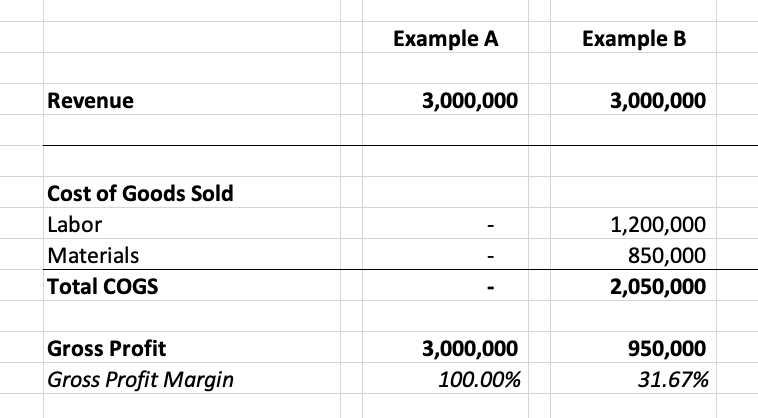

The Profit & Loss Statement of such a company would look like Example A in the image below. What you would want to have is, however, how it would be in Example B.

In sound bookkeeping practices we distinguish between Variable/Direct Expenses Variable Costs (or also called Direct Costs) and Fixed Expenses (or Fixed Costs).

Fixed Expenses and Fixed Costs are used interchangeably but mean the same thing. We also often call Fixed Costs for Overheads.

Variable Expenses, Variable Costs, and Direct Expenses or Direct Costs are all used interchangeably but mean the same thing.

Without the distinction in our bookkeeping of Variable/Direct Costs and Fixed Costs, we will not be able to have a calculation of Gross Profit nor Gross Profit Margin (%).

So let’s dive in and look at it in greater detail:

Gross Profit assesses a company’s efficiency at using its

labor and supplies in producing goods or services.

Gross Profit is calculated by subtracting the Variable (also called Direct) Expenses from your Revenue.

Gross Profit = Revenue – Cost of Goods Sold (GOGS)

Variable Expense & Fixed Expense

The terms Variable or Direct expenses are very descriptive terms if you think about it, for these expenses consist of the expenses that vary with the level of output, or in other words, the expenses are directly associated with the level of output.

As the level of output increases you would expect to see an associated increase in the level of variable/direct expenses. And likewise, as the level of output decreases, you would expect to see an associated decrease of the level of variable/direct expenses.

The major expenses that typically make up your Variable/Direct Expenses are Direct Labor and Materials.

Variable Expenses also include subcontractors and sometimes equipment rental.

Again, remember that the expenses have to be directly associated with producing the output to fit in this category, so all Management Labor expenses do NOT go into this line item in your Profit & Loss Statement. Such management expenses are considered Fixed Costs and should instead appear further down on your Profit & Loss Statement.

The term Fixed Cost is also very descriptive. It says the cost is fixed, i.e. the same, independent of any changes in your output. Your rent is the same. The car payments are the same etc. Fixed Costs are costs that you have to pay in your business that do not vary as your output level changes. Salaries for management employees, including the CEO, Managers and Salaried employees, including bookkeeper etc. will have to be paid regardless of your output going up or going down.

Fixed Costs also include all your expenses for your building, rent/leasehold and/or office, utilities, insurance, office equipment and office supplies, vehicles, advertising, and so on.

What About Vehicles And Such?

Vehicles (leased or financed), equipment and utilities are typically to be found under your fixed expenses. Let’s say, you have one or more vehicles that you are leasing. Your monthly expense for these vehicles do not change depending on the level of your output, which is why it makes sense to have these expenses under Fixed Costs.

Absorption Costing

However, you may feel that some of these vehicles are directly associated with your output. For instance, say you need some of these vehicles specifically for delivering upon your service or for making your production happen. Well, at some point, as your level of output increases enough, it is likely that you would need more vehicles.

To reflect such need for extra resources and to reflect for such expenses, a portion (often a percentage) certain expenses are taken of some of the fixed cost and entered as a variable costs. This method is called Absorption Costing (or often full absorption costing), and is required by Generally Accepted Accounting Principles (GAAP).

For many production or manufacturing companies, expenses for some utilities such as electricity are greatly associated with the level of output. One could have a separate meter for electricity for the actual production hall and another for the office section. Then have the expenses for electricity that are associated with this production hall be listed as Variable cost, while the expenses from the other meter remain under Fixed expenses.

Without a separation of electricity meters, you will typically see the use of a portion/percentage of the fixed expenses being allocated to variable expenses. Likewise with a lot of production/manufacturing companies, you will often see large expenses for liability insurances etc., so often the percentage from a string of fixed costs that would be attributed towards variable costs would reflect that.

For a lot of service companies, or shall we say “office based” companies (e.g. advertising agencies or retail stores) you typically would not find this need to take some portion from your fixed costs and attribute it to variables costs.

The idea is to get a fairly precise insight to the dynamics of your business and its performance without getting too bogged down into minutia of the split of these expenses. When the books are done well, it really takes very few minutes for someone who understands business to get a very good idea about the performance of a business and how such performance would be affected by changes made in the business.

When it comes to taking a portion of your fixed expenses and attributing it towards your variable expenses, what I’m trying to say is that, you would only really want to do so, if a major part of such expenses truly are directly related to the level of output.

As a side note, if you are a publicly traded company the SEC (securities Exchange Commission) requires you to use full Absorption Costing and GAAP principles.

The Quality Of Your Books

The quality of your books and how your Chart of Accounts is set up have great influence on the quality of the reports you can get from your bookkeeping to run your business better and more efficiently.

For many mom and pop companies, mom is often the one who becomes the bookkeeper. Often mom does a great job at this and is sufficiently adequate at doing the company books. But it is important that the Chart of the Accounts (i.e. how the account accounts inside your bookkeeping system are set up) is done well.

Done well means among other things, so that the Cost Of Good Sold are adequately separated from Fixed Costs and such that you can quickly determine your Gross Profits.

Unfortunately, often I have seen even at simple, smaller companies that mom or the hired bookkeeper did not have adequate bookkeeping skills.

Don’t Run Blindly

It is difficult to run a business well when you either run the business “blindly”, as in having no numbers, or when you cannot adequately rely on the numbers that you can get from the company bookkeeping reports.

If your business belong to the group of companies that have a need for more demanding bookkeeping, (e.g. like the manufacturing companies as we touched on above), the need for a skilled bookkeeper increases.

Bookkeeping, regardless of size and complexity of business, is well worth getting right, and you are well advised to make the necessary investment into this.

But Don’t Do The Bookkeeping Work Yourself

Bookkeeping done by the owner him or herself is not something I recommend. Your time as an owner such be much more valuable than the expense you would have to face to hire the skilled bookkeeper at the level you need.

Your time and efforts as an owner should be better focused at making the overall business the best possible, growing it. Or once you have developed your business far enough, and as you have eventually hired people to manage most of the daily operations, perhaps even hired a CEO, to truly promote yourself to just be the business owner, who may contemplate perhaps the higher levels strategic thoughts and planning for your business.

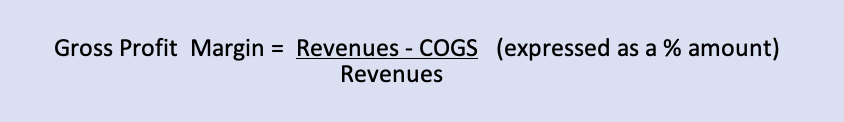

Going back to the Gross Profit Margin the formula again is:

Gross Profit Margin illustrates how well a company is generating revenue from the costs involved in producing the company’s products or services.

As you work on your business and wish to grow it and create better results, the Gross Profit Margin becomes particularly important to keep an eye on.

Especially seeing that you can increase your Gross Profits while your Gross Profit Margin actually decreased.

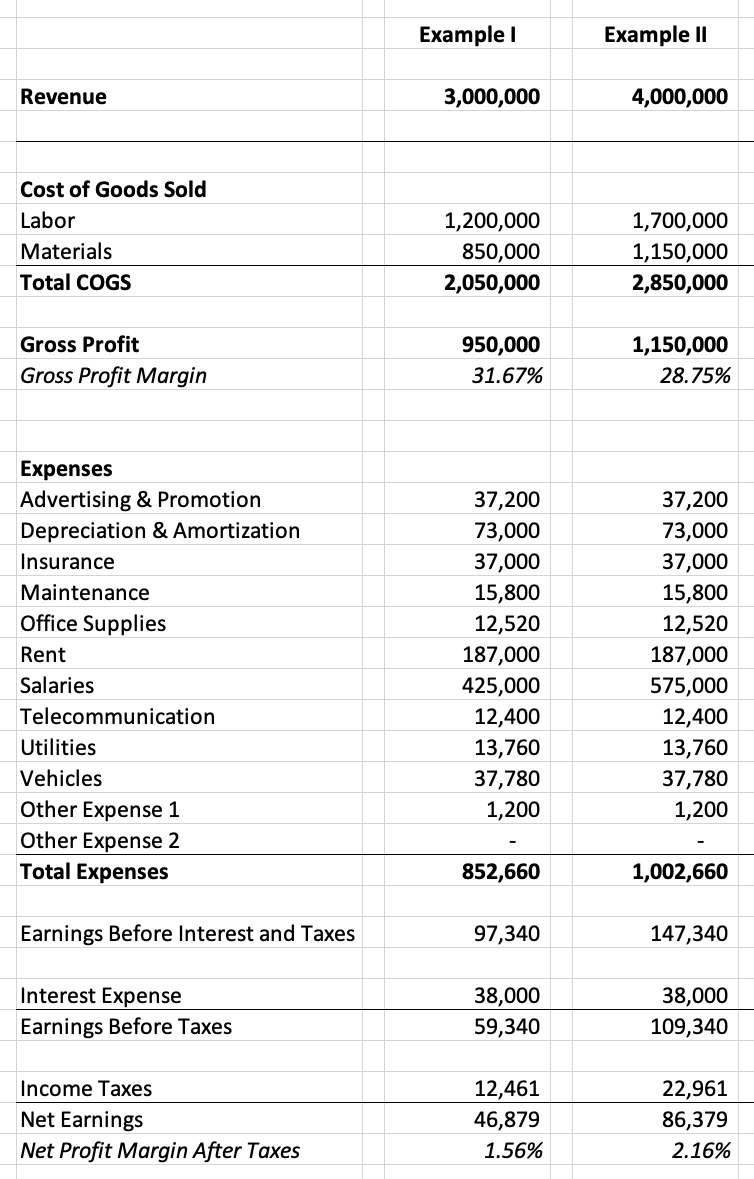

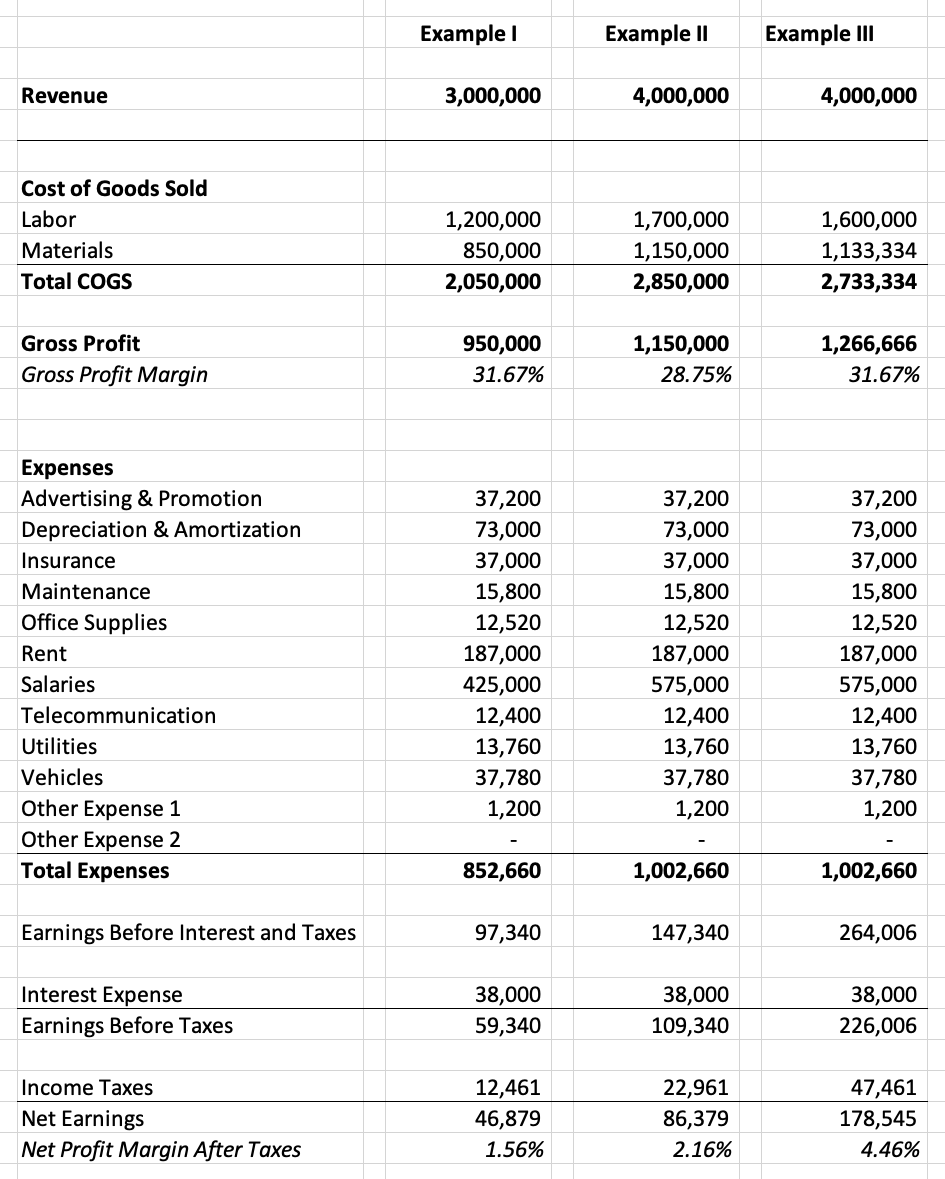

An example to illustrate this is in the image below:

Growth Is Great

In the image, Example I is your base year. Imagine in the following year you grew your Revenue by $1,000,000 from $3,000,000 to $4,000,000 as shown in Example I and Example II.

That represents an amazing growth of 33.33%.

This remarkable growth also results in a nice growth in our Earnings Before Interest and Taxes, from $97,340 to $147,340 which represents an increase of about 51.37%.

But Often Comes At A Cost

The growth in Revenue is great, but if you compare Example I with Example II, you’ll find that the efficiency with which this company produced the goods or services actually decreased.

Instead of achieving a Gross Profit Margin of 31.6% it ended with one of 28.75%. So although the overall result (or net result) improved and even though you made considerably more money, you could have made much more money if you had been able to maintain your original efficiency, while increasing the revenue as you did.

The latter is illustrated by Example III in the illustration below:

So in Example III, we have achieved the remarkable growth of over 33%, but we have maintained the level of efficiency that we had in our base year.

The difference in results is astounding.

Instead of increasing our Earnings Before Interest and Taxes from $97,340 to $147,340, we have now achieved an amazing $264,006, which is a result more than 2.5 times greater than the result of our base year. When we increased our Sales but also dropped our efficiency, our results was about 1.5 times larger than the base year.

The Assignment For The Business Owner

There are many considerations to make in business and there are many strategies. As a Business Turn Around Agent, or as a Business Consultant in general, the charge is often to make more money.

In your business, you are the Business Consultant and your charge is to make more money.

Often business owners either think or are somewhat stuck on the notion that they will need to increase sales a lot to make more money. While I always like to achieve more sales, comparing Example II and Example III, clearly demonstrates that by improving efficiency in your business you can make considerably more money.

Let’s Look At Improving Efficiency In Greater Detail

Let’s drive the clarification of the power of efficiency improvements home even more.

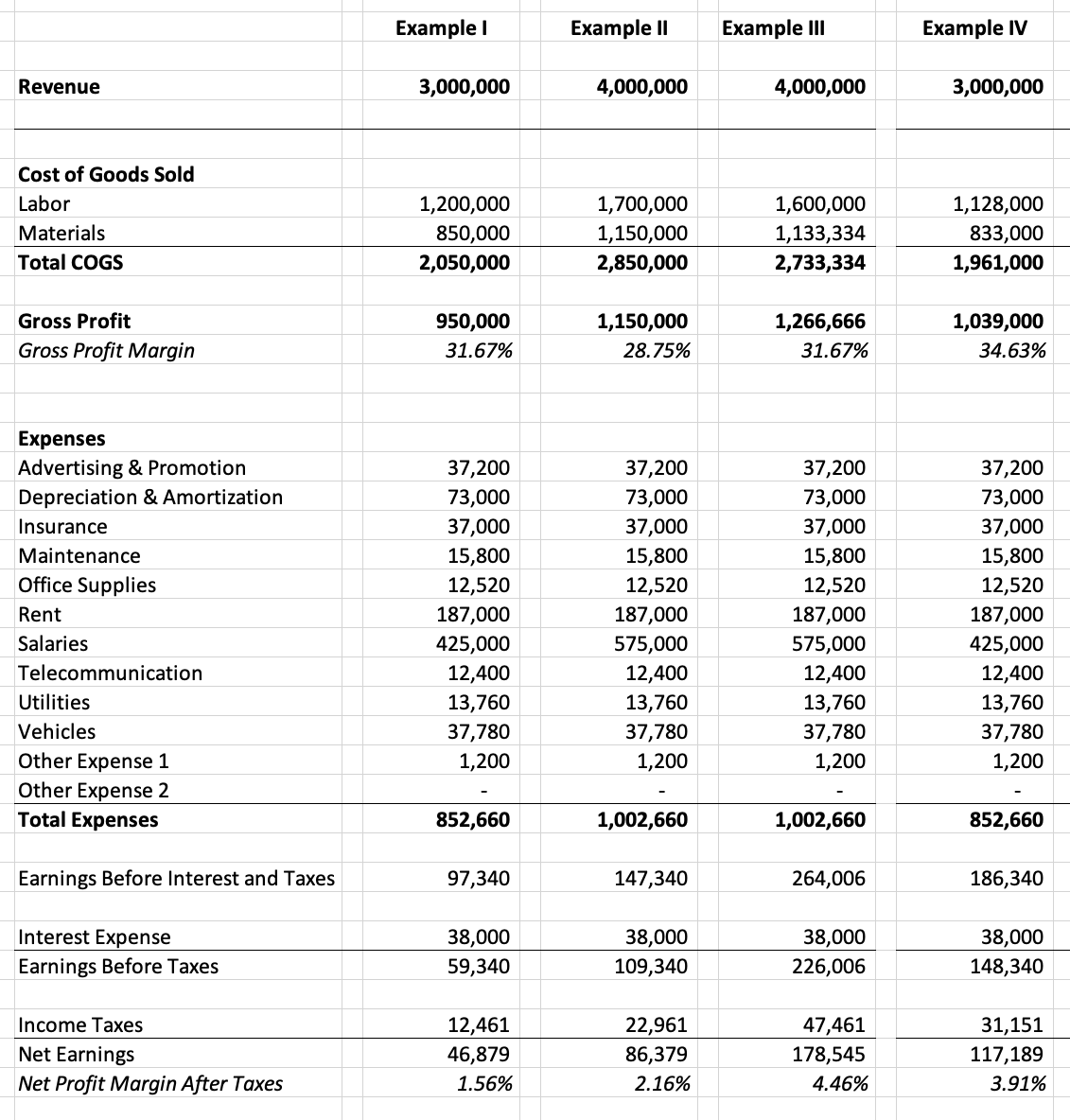

In the illustration below, we look at our base year again, but instead of increasing the Sales, let’s just improve upon the efficiency and see what results come off of that:

We are now looking at Example IV.

Now the Sales are maintained at $3,000,000 for the two years.

But we have improved our efficiency by 6% on the Labor Costs and by a mere 2% on the Material Costs.

Let’s say we were able to increase our productivity and make some more efficient arrangement in how we operate on a daily basis so that we achieved these improvements in our Labor Costs.

For materials, perhaps we eliminated a little of our spillage/wast or perhaps we negotiated a slight improvement in our purchasing prices.

While the overall improvement in efficiency , as meassured by the Gross Profit Margin % is just shy of 3%, the improvement in our Earnings Before Interest and Taxes is an amazing one, from $97,340 to $186,340.

An almost doubling from a mere 3% improvement.

The Message

The message is clear to us, I believe, that improvements in efficiency in our production of our goods or services go a long way.

We get the benefit on every single item dollar, and we get the full dollar benefit from every single saving we are obtaining.

When we complete extra sales, we get the benefit of the Gross Profit Margin per dollar sold. So if we sell e.g, an extra dollar’s worth, then we retain from Example I roughly an extra $0.32. When we made the improvements in Example V we get an extra $0.35 from every extra dollar sold (approximately).

So Does That Mean…?

OK, so does that mean, I should just focus on getting my efficiency up?

Well, for sure the effects that trickle through your results in the business benefits greatly from your imrpovements.

That being said, let’s not forget that without Sales we really have nothing, so we should never forget to tend to our Sales.

In fact I would also venture to say, that generally speaking, you, as a business owner, should always aim to keep growing your business.

Yes, there can be times, when further growth is perhaps less advantageous and when we have hit certain ceilings, which would require too large investments to break through in order to deliver on more services or products. But in general, most businesses should continuously make some efforts for growth.

But If I Split My Focus…

Yes, you’re right.

When you split your focus among several things, it is more challenging getting the same results out of your efforts. But that’s why we have a team in business.

With the right system and allocation of resources, skills and people, you can have simultaneous great focus within your business to grow Sales, while working on your Effciency in your Operation and even while ensuring you are solidly on top of your Finance segment of your business too.

A Great System and Method

This is where having a great System and Method make all the difference.

My many colleagues and myself have been using very unique business system and method for improving and running businesses, turning failing businesses into successful ones, and up-leveling great businesses up to even greater ones.

Our success rate has been reported to be some 97-98% as reported by our clients and as proven by seeing their performance improvements as shown in their Profit & Loss statements following our engagements with them.

It would be difficult to predictably obtain successful outcome after successful outcome without a system and a method. What’s even better is that with a system and a method you have something that is teachable and repeatable.

Teaching You How To Fish

Whenever we help a client, we are not just focused on making the client more money, but also focused on teaching the client and his/her team how to use the same method and system we use, so they can continue the path of running a business efficiently and profitably even after we as business consultants leave.

Here’s What I’ve Got

I have taken all my experiences, my insights and skills from business, from running and operating my own businesses, from the businesses that I was hired to run, and from all I learned from having served more than 100 business clients in person and on site, and I have taken a great business system and method and I have taken all of this and developed it all further into a very comprehensible, yet easy to learn and easy to follow business system and method.

I call it

The Automated Millionaire Business System

If you want to see what this is all about, so you can implement it too in your business, so you can secure that you and not least your team can run your business efficiently and successfully and of course to great profits, then here’s what I’d like you to do next:

Watch this video which will show you the method and system. There’s no cost to watch this video, and I really show you the entire system.

You’ll love it I’m sure.

The system really is just a simple 8-step Business System For Real And Great Success.

Again go and watch it now.

Still Here?

Still Here?

Didn’t zoom over to watch the video yet?

OK, that’s fine. I actually wanted to go back to our business examples again.

You asked what you should focus on, and my answer pretty much is that we want to focus on Sales, Operations and Finance at all times in our business.

I go a bit deeper on that subject in my business training and coach program The Automated Millionaire Business System.

In the program and coaching I go deeper on how to accomplish all of that with ease and such that you’re actually left with more time on your hands to pursue or spend on other things of your liking.

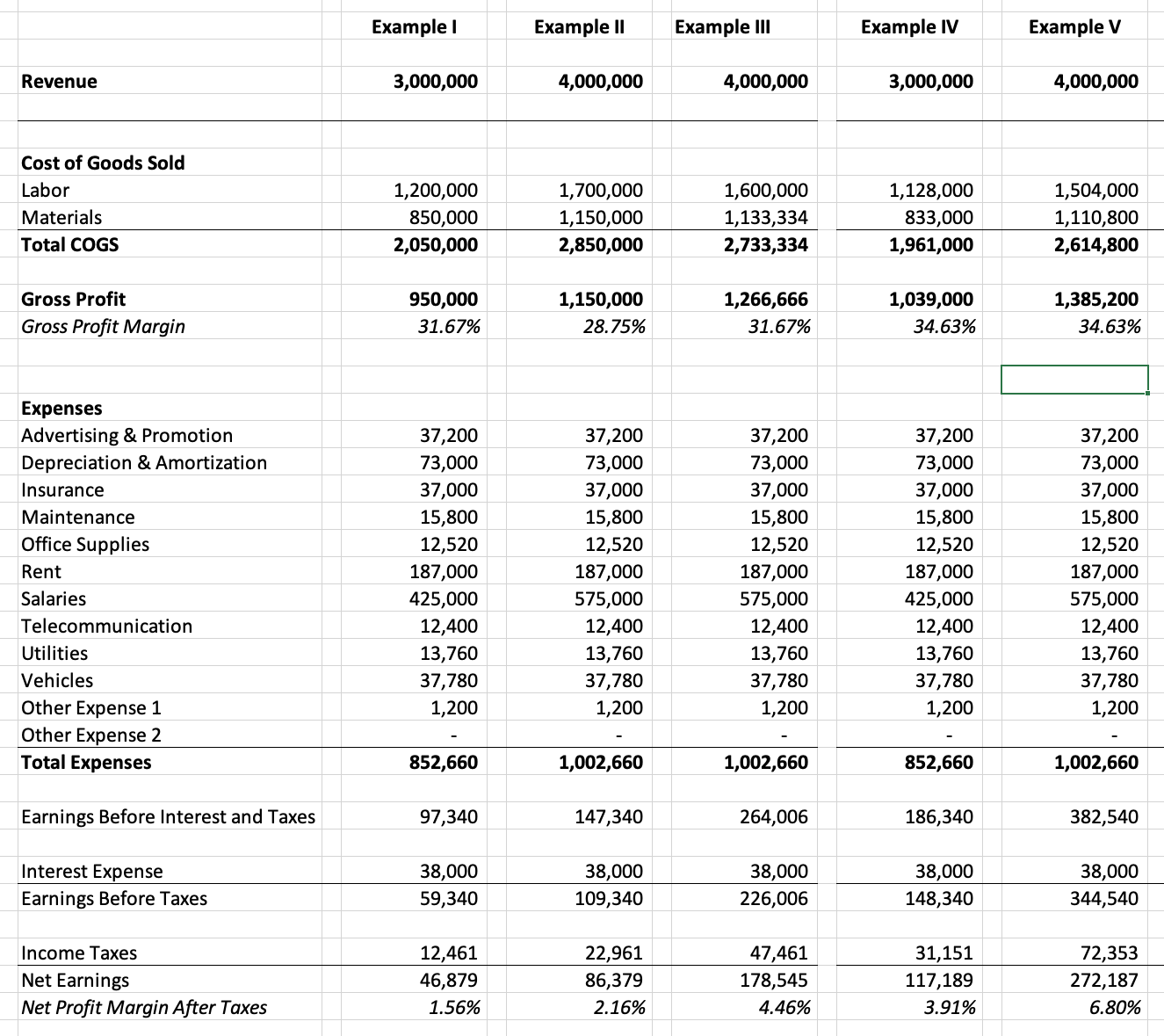

But for now, let’s quickly revisit our business example:

In Example V we have not just increased our Sales by the same remarkable 33.33%, but we have also increased our efficiency by the same factor just shy of the 3% as in previous example.

The result is that we now have $382,540 in Earnings Before Interest and Taxes. An almost quadrupling of our result.

What’s the message?

Yes, It Pays To Improve Your Sales, Your Efficiency, And Your Finances

Alright, my suggestion to you again is to jump over and watch the no-cost-training video on the method and system that I have.

The simple 8 step business system for success and great profits.

I’d Love To Receive Your Feedback

I’ve written this article with clear intent of helping as many business owners as possible. I hope that you found it helpful and that perhaps it gave you a better understanding of the dynamics of business, so you can turn this into actions you implement in your business so you’ll make more money.

I’d love your feedback, so by all means please feel free to shoot me a quick email.

My mission is to help as many people as possible.

I focus on Entrepreneurs because that’s where my greatest expertise and skills are. I have extremely vast and extensive experience and I have already helped a lot of people.

My efforts these days are much on bringing this help online and to more easily access to many more people than I could ever hope to help and serve in person and on-site.

When I have helped people in person and on-site, I can only help one company at the time. But online I can help many, more people at the same time.

Benefits With The Online Program And Coaching

There are lots of benefits to this, but just to mention a few, allow me to highlight the following:

1. As a client your access price and investment become much, much less than when you have a business consultant on-site.

In fact you only pay a fraction of the investments that my on-site clients have paid.

2. You also have access to the training material all the time, so you can study it at your leisure and when it fits your schedule. Furthermore, it doesn’t cost extra to view, and review, and view it again and again again.

Were you to pay me as a consultant on-site, everytime you are asking me to show you the same thing again, you are basically paying for it again.

3. Group coaching carries even more benefit for everyone. A question that someone ask often spurs ideas and solutions in your mind. You’ll often find that someone else asked a superb question that you did not think of asking, but now that it’s asked, you’re delighted for the answer may be just what you have been looking for also for your business challenge.

4. Regular Group Coaching calls, means that you’ll have direct access to me included in your training and coaching program. That means that you will not be left behind, if there was something you didn’t quite understand from the training material.

5. The coaching call access also means that you can have my personal help in solving your current business challenges.

6. Comaraderie and group of likeminded people. Everybody in my programs and coaching are part of a private group. Everybody is in the same boat, and have the same aspirations. This is huge for upkeeping motivation and for also finding solutions among peers. Confidentiality and mutual respect, curtesy and dignity governs this group of individuals and the private group.

Inquire with me for more information on this, or go and watch the video for more.

The Automated Millionaire, its programs and coaching has been created by lifelong entrepreneur and successful business mentor.

Mikkel’s entrepreneurial journey is vast and very extensive, with experience spanning Denmark, Norway, Sweden, Germany, Poland, the UK, US and Canada. Several cultures, currencies, countries, and States. Many unrelated industries and businesses in all kinds of stages and developments.

His journey includes job positions at every level of an organization from the very bottom of the totem pole working his way up to the very top of same company. It includes private companies as well as publicly traded companies.

His big focus now is helping as many business owners and entrepreneurs create the results they need to pave the way for the lives they have always desired, and for the benefit of not only themselves, but also for their families, and the people they employ and their families.

Mikkel offers this via his brand The Automated Millionaire.

The Automated Millionaire helps small and medium sized businesses achieve greater profits and more efficiently run operations without having to work harder and we do so by implementing a specific and simple 8-step business method called The Automated Millionaire Business System

Mikkel Pitzner (or The Automated Millionaire) can not and does not make any guarantees about your ability to get results or earn any money with our ideas, information, tools, systems, methods or strategies.

Nothing on this page, any of our websites, or any of our content or curriculum is a promise or guarantee of results or future earnings, and we do not offer any legal, medical, tax or other professional advice. Any financial numbers referenced here, or on any of our sites, are illustrative of concepts only and should not be considered average earnings, exact earnings, or promises for actual or future performance. Use caution and always consult your accountant, lawyer or professional advisor before acting on this or any information related to a lifestyle change or your business or finances. You alone are responsible and accountable for your decisions, actions and results in life, and by your registration here you agree not to attempt to hold us liable for your decisions, actions or results, at any time, under any circumstance.

This site is not a part of the Facebook website or Facebook Inc. Additionally, This site is NOT endorsed by Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc